小心这些人寿保险受益人的错误

Life insurance has long been recognized as a useful way to provide for your heirs and loved ones when you die. While naming your policy’s beneficiaries should be a relatively simple task, there are a number of situations that can easily lead to unintended and adverse consequences. Here are several life insurance beneficiary traps you may want to discuss with a professional.

未指定受益人

The most obvious mistake you can make is failing to name a beneficiary of your life insurance policy. But simply naming your spouse or child as beneficiary may not suffice. It is conceivable that you and your spouse could die together or that your named beneficiary may die before you and you haven’t named successor beneficiaries. If the beneficiaries you designated are not living at your death, the insurance company may pay the death proceeds to your estate, 这可能会导致其他潜在的问题.

死亡抚恤金支付给你的遗产

If your life insurance is paid to your estate, several undesired issues may arise. 第一个, 保险收益可能要接受遗嘱认证, 这可能会延迟支付给你的继承人. 第二个, life insurance that is part of your probate estate is subject to claims of your probate creditors. Not only might your heirs have to wait to receive their share of the insurance, but your creditors may satisfy their claims out of those proceeds first.

指定未成年子女为受益人

Insurance companies will rarely pay life insurance proceeds directly to a minor. 通常, the court appoints a guardian — a potentially costly and time-consuming process — to handle the proceeds until the minor beneficiary reaches the age of majority according to state law. If you want the life insurance proceeds to be paid for the benefit of a minor, you may consider creating a trust that names the minor as beneficiary. Then the trust manages and pays the proceeds from the insurance according to the terms and conditions you set out in the trust document. Consult with an estate attorney to decide on the course that works best for your situation.

取消受益人获得政府援助的资格

A beneficiary you name to receive your life insurance may be receiving or be eligible to receive government assistance due to a disability or other special circumstance. Eligibility for government benefits is often tied to the financial circumstances of the recipient. The payment of insurance proceeds may be a financial windfall that disqualifies your beneficiary from eligibility for government benefits, or the proceeds may have to be paid to a government entity as reimbursement for benefits paid. 同样,房地产律师可以帮助你解决这个问题.

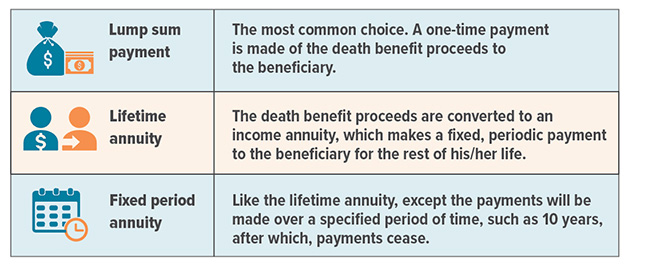

人寿保险赔付选择

Most life insurance policies offer several options to the policy beneficiary, including:

制造应税情况

Generally, life insurance death proceeds are not taxed when they’re paid. 然而, 这条规则也有例外, and the most common situation involves having three different people as policy owner, 被保险人, 和受益人. 通常, the policy owner and the 被保险人 are one and the same person. But sometimes the owner is not the 被保险人 or the beneficiary. For example, mom may be the policy owner on the life of dad for the benefit of their children. 在这种情况下, mom is effectively creating a gift of the insurance proceeds for her children/beneficiaries. 作为捐赠人,妈妈可能要缴纳赠与税. Consult a financial or tax professional to figure out the best way to structure the policy.

As with most financial decisions, there are expenses associated with the purchase of life insurance. 保单通常包含死亡和费用费用. 除了, 如果保单过早放弃, 这可能涉及退保费和所得税. The cost and availability of life insurance depend on factors such as age, 健康, 以及所购买保险的种类和金额.

虽然信托提供了许多优势, they incur up-front costs and often have ongoing administrative fees. The use of trusts involves a complex web of tax rules and regulations. You should consider the counsel of an experienced estate planning professional and your 法律 and tax advisors before implementing such strategies.